do you pay california state taxes if you live in nevada

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those services.

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Thats due to the source rule.

. Is particularly experienced in the tax rules and planning aspects of relocation from California to Nevada and can help you evaluate your potential for state income tax savings by claiming Nevada residency. However even though you do not live in California you still must pay tax on income earned in California as a nonresident. If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of company do I have to pay California state taxes for 365 days or for just 65 days.

Do I pay California income tax if I live in Nevada. If you lived inside or outside of California during the tax year you may be a part-year resident. Can the state of California tax me on wages if I lived in Nevada all year.

That amount accounts for federal income taxes state income taxes sales taxes and property taxes. Californias Franchise Tax Board administers the states income tax program. Say however you move on June 30 2011.

12 Do you pay California state taxes if you live in Nevada. The state of California requires residents to pay personal income taxes but Nevada does not. Under certain conditions the FTB will exempt specific individuals from state income tax requirements.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. Therefore depending on your total income you may have made enough money in California for them to have taxed you through the year. California taxes all taxable income with a source in California regardless of the taxpayers residency.

Georgia residents and nonresidents pay a gambling tax by state of 6 along with the federal tax rate of 24. Nevada imposes no income tax whatsoever on individuals or on business entities. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada.

Do I have to pay California taxes if I live out of state. Alabama is subject to a gambling winnings state tax of 2-5 depending on your winnings. California Tax Rules For Remote Employees.

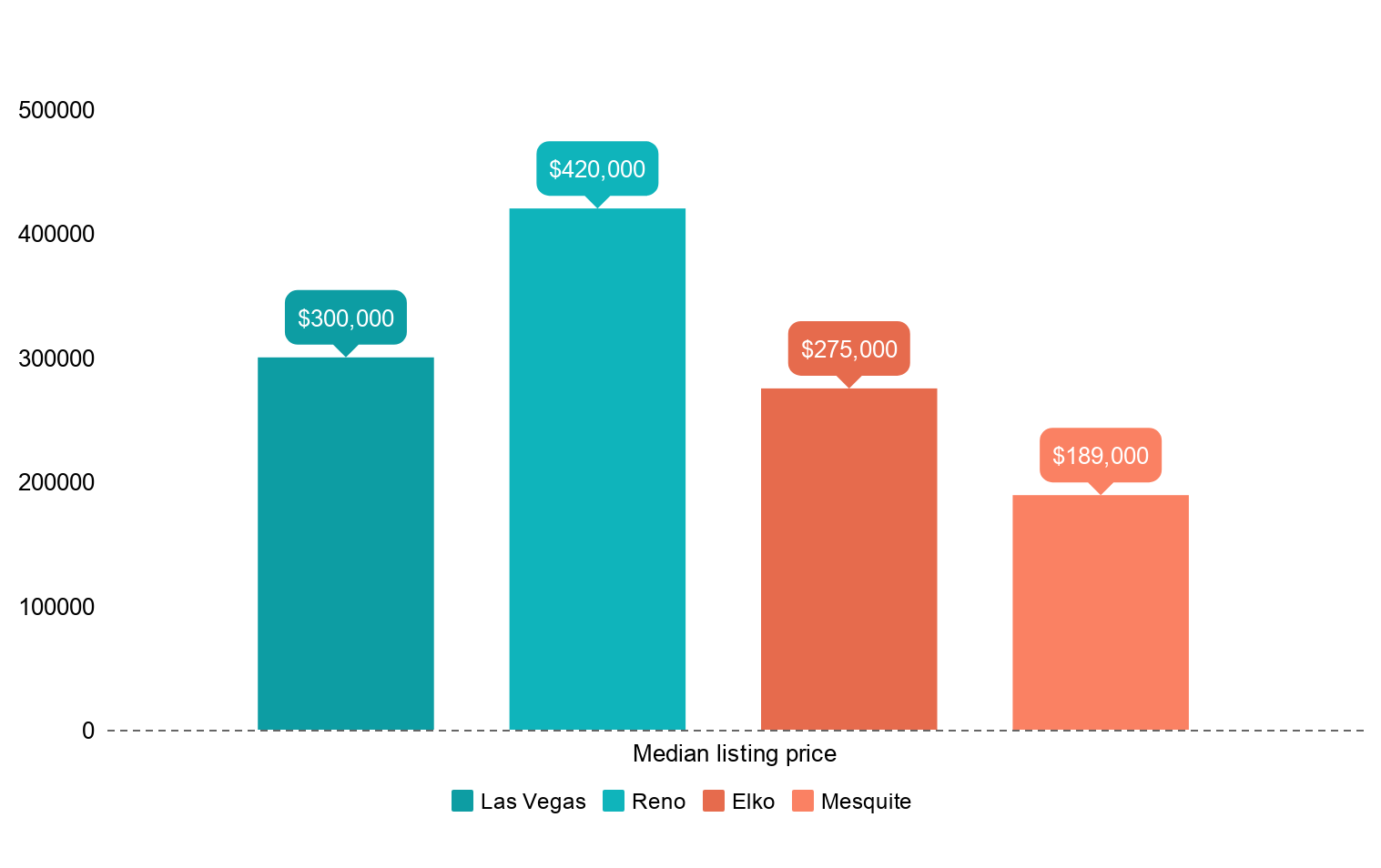

Do you pay california state taxes if you live in nevada. Taxpayers in Nevada must pay a larger percentage of their income than the average American. 18 How do you get dual residency in.

The employer should be withholding california state income taxes from your wages. Once you reach 500 you have to pay 2 on your winnings. You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like NevadaThe second rule is that California will tax income generated in the state regardless of where you live.

Californias Franchise Tax Board administers the states income tax program. In Nevada there is no income tax imposed. Does the fact that you lived in California from Jan.

You will want to check your w2 for california incomewithholding and file what the company reported. In Nevada there is no income tax imposed on S-corporations. The state of California requires residents to pay personal income taxes but Nevada does not.

So if you own California real estate but live in New York you still have to pay. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. 16 How long can you live in another state without becoming a resident.

17 How do you establish state residency. You will want to file the non-resident first and then your Nevada state return so that your state return can be calculated correctly against any credit from the non-resident CA state return. If you move from California to Nevada this seems to avoid California state taxes in many instances.

In California partnership LLCs pay a tax ranging from 1700 to almost 12000 per year depending on the net taxable income of the entity. In California S-corporations are taxed at a rate of 15 on the net taxable income with the minimum tax being 800. Californias Franchise Tax Board administers the states income tax program.

15 How does IRS determine state residency. Social Security retirement benefits are exempt but California has some of the highest sales taxes in the US. However even though you do not live in California you still must pay tax on income earned in California as a nonresident.

Since Nevada has no personal income tax system you have no need to file any tax return there and there is no state tax credit that you would need to then claim on your California state tax return1 If you live in NV and work in CA then CA taxes all of your wage job income. California taxes all taxable income with a source in california regardless of the taxpayers residency. If you live in California you probably know how aggressive Californias state tax agency can be.

Skip to content All About Incomes Questions and Answers All About Incomes Questions and Answers. It is true that in Nevada you do not pay tax on that income but California can tax you. Californias Franchise Tax Board administers the states income tax program.

Ashley Quinn CPAs and Consultants Ltd. 14 What happens if you dont spend 183 days in any state. In fact even if you live somewhere else you might have heard of.

All worldwide income received while a. The state of California requires residents to pay personal income taxes but Nevada does not. As a part-year resident you pay tax on.

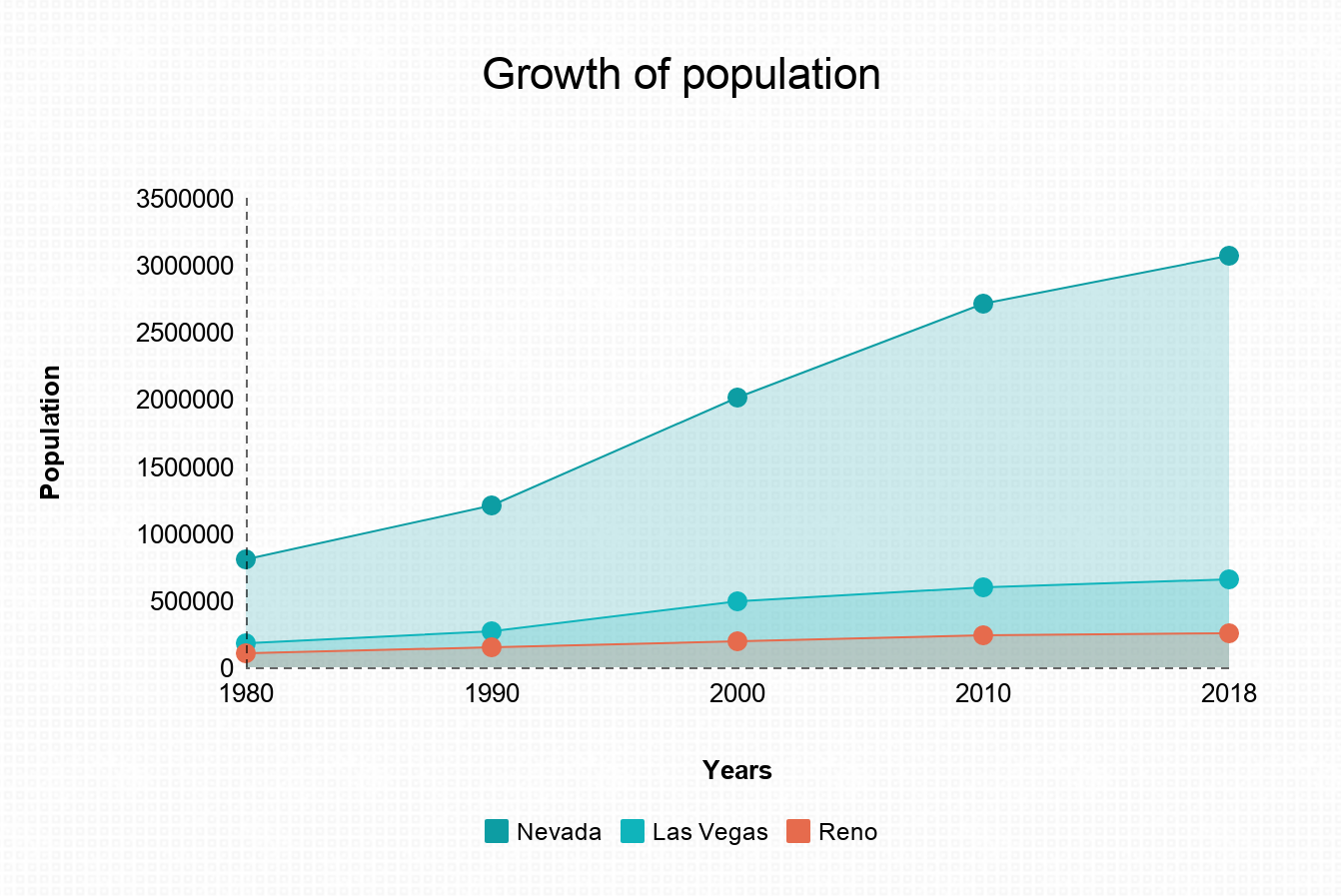

Yes you need to file a non-resident state return for the California income. A 2018 GOBankingRates study found that the average Nevada resident will pay over 11000 in taxes each year or about 21 percent of their annual earnings. 13 How does the 183-day rule work.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. 1 to June 30 2011 make all of your 2011 income taxable as if you were a California resident for the entire year. It is true that in Nevada you do not pay tax on that income but California can tax you.

The state of California requires residents to pay personal income taxes but Nevada does not.

Moving From California To Nevada Or Arizona Which Is Better Rpa Wealth Management

Ipl2 Stately Knowledge Facts About The United States Us State Map Map Games United States Map

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

You Re Just One Funnel Away Funnel Hacking Live 2020 January 29 February 1 2020 In Nashville Tennessee Join Russ Landing Pages That Convert Online Marketing Internet Marketing

Nevada Vs California Taxes Retirepedia

Nevada Vs California Taxes Retirepedia

Moving To Nevada From California Retirebetternow Com

Nevada Vs California Taxes Retirepedia

Pros And Cons Of Moving To Nevada From California

South Shore Lake Tahoe South Lake Tahoe Lake Tahoe Lake Tahoe Nevada

Pros And Cons Of Moving To Nevada From California

Pros And Cons Of Moving To Nevada From California

Pyramid Lake Nevada So Close To Reno Nevada Travel Travel California Camping

If I M Working For A Company In California And Live In Nevada What State Are My Paying Taxes To Quora

Nevada Vs California Taxes Explained Retirebetternow Com